1. Create a Company Name – Find if your name is available

Some states allow you to have the same name as a different company if you are a different type of organization. In Wyoming, however, currently, you are not allowed to have the same name as a company already created. Example: A business that sells homemade items could be named Heart to Heart, and another bakery company could also be Heart to Heart. However, in Wyoming, your name must be different. When I filed for a non-profit, I had to name the company Heart to Heart – WY because Heart to Heart was already taken by a different type of organization. Make sure the name you want is available here!

2. Pick a Business Entity

The type of entity you decide on determines what income tax you will have to file. Are you looking at a non-profit, an LLC, or a sole proprietor? To determine which entity is best for you, visit the IRS website here!

3. File your business

After finding that your name is available and determining which entity type you will be, you can file your business name here.

4. Register your Agent Information

Every business in Wyoming must have an agent registered for their business. If you are a sole proprietor, you can use your own name and address. However, one very important thing you must know is that the agent MUST live in Wyoming. The Wyoming Secretary of State has a great page regarding who can and cannot be a registered agent for your company. You can find a link to that page here. Otherwise, you can file your registered agent here.

5. Fill out your Forms

Although this seems easy, the state of Wyoming is very specific about which forms you need to fill out. Here is a website for you to find the proper form to fill out.

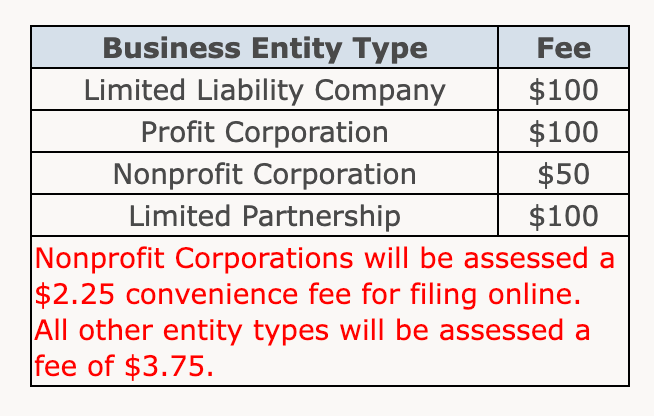

6. Pay the Fee

You have heard the term "nothing in life is free." Well, business isn’t free either. Depending on the type of business you are applying for, it will cost money. Make sure you have this money available to start your business. Different entities cost different amounts to register, so check out this list to see how much your new business fee will cost.

7. Get your business permitting, sales and use tax.

I will make this one super easy for you: the Secretary of State for Wyoming has an amazing page where you can find all the websites to search for this. To access it, you must go to the Wyoming Government website and create an account.

8. Get Workman’s compensation and unemployment

Workman’s Compensation can be an important thing for your business. If one of your employees gets injured on the job, and you don’t have workman’s compensation, it could shut you down forever. Here is more information regarding workman’s compensation.

9. Get insurance

Although many of us might think that insurance might not be the most important thing when opening a business, it did make it in my top ten list. This is because if you have to relieve someone of their position and they file for unemployment, unemployment insurance will protect you as a business owner. For more information regarding unemployment insurance in Wyoming, click here.

10. Get your EIN

a. Although this is one of the most important things in order to run a business legally in the United States, I have it as my number ten. If you haven’t completed numbers one through nine, you shouldn’t be starting on number ten. An EIN is much like a social security number but for your business. It stands for an Employee Identification Number, and it allows the IRS to identify businesses that are required to file different business tax returns. To file for your EIN, click here.

For your final view, if you are interested in watching a video on how to start a company in Wyoming, here is one I found on YouTube. Let me know what you think and if you think it follows the 10 steps above that I talked about.